The Colorado Department of Revenue’s Marijuana Enforcement Division released the 2019 Regulated Marijuana Market Update showing the regulated marijuana market continues to meet resident and visitor demand.

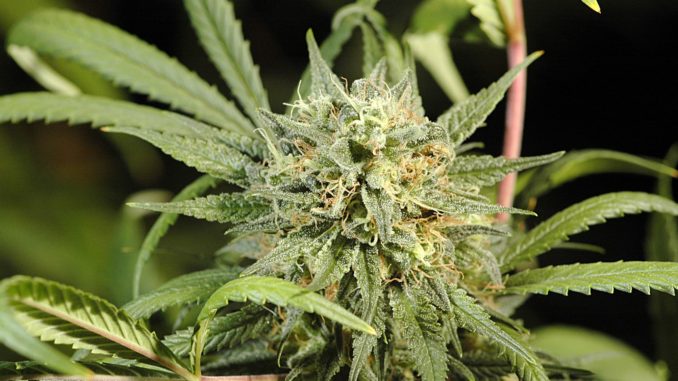

The update also shows that concentrates are continuing to gain market share in the legal marijuana marketplace. Colorado is still a competitive place for marijuana businesses, with price stabilization suggesting the market has matured. An in-depth analysis of individual sales transactions is a new addition to this year’s report. It is used to compare the medical and adult-use markets, including additional charts and graphics that illustrate the production and sales trends for marijuana.

“It is more important than ever to understand the landscape of Colorado’s legal marijuana market using sophisticated data analysis,” said Jim Burack, MED Director. “This report serves as a vital tool to regulators, policymakers, public health experts, stakeholders, and the public in providing insights on how market share, price, and potency evolve over the years,” Jim said.

Key findings of the study are as follows:

- Colorado’s marijuana market has matured, given the prices first bottoming out in Spring 2019 and now remaining steady after a gradual increase. Additionally, the slow decline in the number of new business licenses, supply and cultivation volume showing steady patterns throughout the year, and slowing growth overall support evidence of market maturity.

- The concentrate market continues to grow. Concentrates now make up over 32% of the adult-use market share, compared to 46% for flower and 13% for edibles. In 2017, concentrates made up about 23% of the adult-use market. Concentrates, which are higher in potency than flower, is now being sold at roughly the same price per dose as a flower. The price per dose analysis is conducted by converting concentrate to a flower equivalent number.

- Though consolidation continued in 2019, Colorado remains a highly competitive marketplace for marijuana businesses. The largest five operators accounted for 18% of total market sales in 2019, while the top 10 operators accounted for 25% of sales (up slightly from 23% in 2017).

- New to the report this year is an analysis of individual sales transactions. Data shows that the average medical transaction is almost double the average adult-use transaction. This may be consistent with higher purchase limits allowed for medical marijuana patients. While adult-use marijuana sales are still increasing, medical marijuana sales have been relatively steady for several years.

- The total amount of regulated marijuana that is seized, destroyed, does not meet quality assurance standards, or is otherwise taken out of the supply chain has continually decreased over the last three years. This ‘residual’ as a percentage of the inventory has declined each year and now represents only 3% of the total supply, down from 5% in 2017. This measure indicates continued improvement in compliance, more accurate reporting, better internal controls, better use of the inventory tracking system by state and industry, and an effective regulatory and enforcement system.

- The gains in compliance are notable when considering the overall supply increased over the same period.

- Per capita sales numbers were evaluated, and there are higher sales numbers in counties with a high number of tourists and visitors from out of state and some border regions. Monthly adult-use sales per capita for Colorado was $21.68 in 2019.

- Overall, marijuana cultivators are not utilizing the maximum plant count allocations authorized by MED, which indicates licensees are engaging in responsible production and cultivation practices and that the market appears to adjust appropriately based on supply, demand, and seasonality. Actively monitoring production management remains a MED priority to discourage over-supply and right-size cultivation levels.

- The medical marijuana industry has historically utilized 40-60% of the possible allocations, declining from 60% in 2017 to 42% in mid-2019, but then slowly increased to 48% by the end of 2019.

- The adult-use marijuana industry has utilized 38-45% of the available allocations, with seasonal influxes likely driven by outdoor cultivations during the growing season.

Consumption of non-flower products is not captured in the Federal survey data, leading to underestimating resident and visitor consumption estimates, especially legal in-state purchases made from out-of-state visitors who come to Colorado specifically for marijuana.

“By all measures the Colorado regulated marijuana market reached the next step in its evolution by year-end 2019, it has become more productive, efficient and compliant,” said Adam Orens, Managing Director of MPG Consulting. “The sales and price figures show that a well-structured market can replace the illicit market for residents and visitors, and provide an economic driver for the state,” Adam said.

For more information, including the complete 2019 Regulated Marijuana Market Update and supplemental materials, visit MED’s website: https://www.colorado.gov/pacific/enforcement/marijuana-related-reports-studies.

Support Northern Colorado Journalism

Show your support for North Forty News by helping us produce more content. It's a kind and simple gesture that will help us continue to bring more content to you.

BONUS - Donors get a link in their receipt to sign up for our once-per-week instant text messaging alert. Get your e-copy of North Forty News the moment it is released!

Click to Donate