By: Kareen Kinzli Larsen

Realtor at RE/MAX Alliance

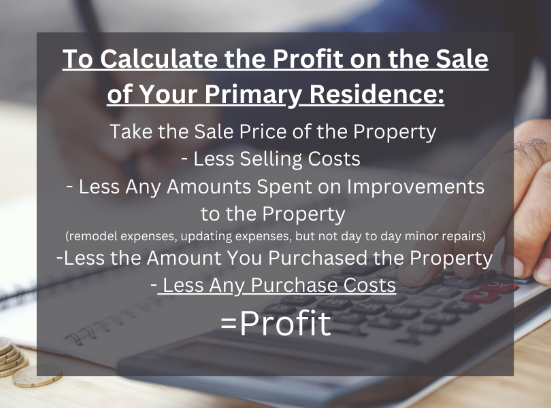

You always have a silent partner to whom you owe a portion of the profits from your hard work. This silent partner, ready to cash in on your success, is known as the IRS. One of the few exceptions to the Federal Government’s requirement to pay capital gains tax on a long-term investment is on the sale of your primary residence. However, with the recent rapid appreciation in real estate values, we are more often seeing examples where homeowners are forced to pay capital gains with the sale of their property.

Twice already this month, I have sat with elderly homeowners who need to sell because they can no longer maintain their properties. They have lived and raised their families in these properties for decades, lovingly caring for their homes or acreages, and now they need the equity out of the property to purchase a more suitable home. They cannot do it without paying tens of thousands of dollars, if not over one hundred thousand dollars, to Uncle Sam, diminishing their buying power for their replacement property and lowering the amount available for long-term care.

Many assume that you do not have to pay capital gains if you are purchasing another home. This is not the case. If you have lived in your home for two out of the past five years, and you have not sold another primary residence in the last two years, you are exempt from capital gains tax for the first $250,000 of profit as an individual or $500,000 of profit as a married couple filing jointly. Any profits over this will be subject to capital gains. Long-term capital gains rates depend on your income, but generally range between 15% – 20% federally, and 4.55% for Colorado.

To put things in perspective, the exemption amounts of $250,000/$500,000 were established with the Tax Payor Relief Act of 1997. The median home value in the US at that time was around $150,000. Almost 30 years later, the median home value in the US has increased to around $417,000, and the median home value for Larimer County is around $517,000. We can all agree it is wonderful to have appreciation on your primary residence, but when you are purchasing a replacement property in the same area, you do not have as much left over for that next property after paying the IRS.

Unique Opportunities for Primary Residences with Farm and Ranch or Business Uses

The Kinzli Team has had great success helping property owners with a separate building lot, farmers and ranchers, or property owners with a significant business use, to defer the profits above the primary residence exemption with a 1031 tax deferred exchange. Normally, a 1031 exchange allows you to sell an investment or rental property if you purchase another investment or rental property with the same or greater value. This tax provision still applies to the vacant lot or the business portion of your primary residence.

The best example is the sale of a large production acreage where the owner has lived in the home as their primary residence. We work with the homeowner to apply as much reasonable gains to the sale of the house and a small allocated portion of the acreage to maximize the $250,000/$500,000 gain. We then calculate the value of the remaining production farmland or ranchland and utilize the 1031 process to purchase another farm or even a rental property. We have been able to help sell the farm and purchase a suitable smaller replacement property, all while adding a rental property for long-term income and avoiding long-term capital gains.

Support Northern Colorado Journalism

Show your support for North Forty News by helping us produce more content. It's a kind and simple gesture that will help us continue to bring more content to you.

BONUS - Donors get a link in their receipt to sign up for our once-per-week instant text messaging alert. Get your e-copy of North Forty News the moment it is released!

Click to Donate